Anantam International SPC Fund - 6 SP

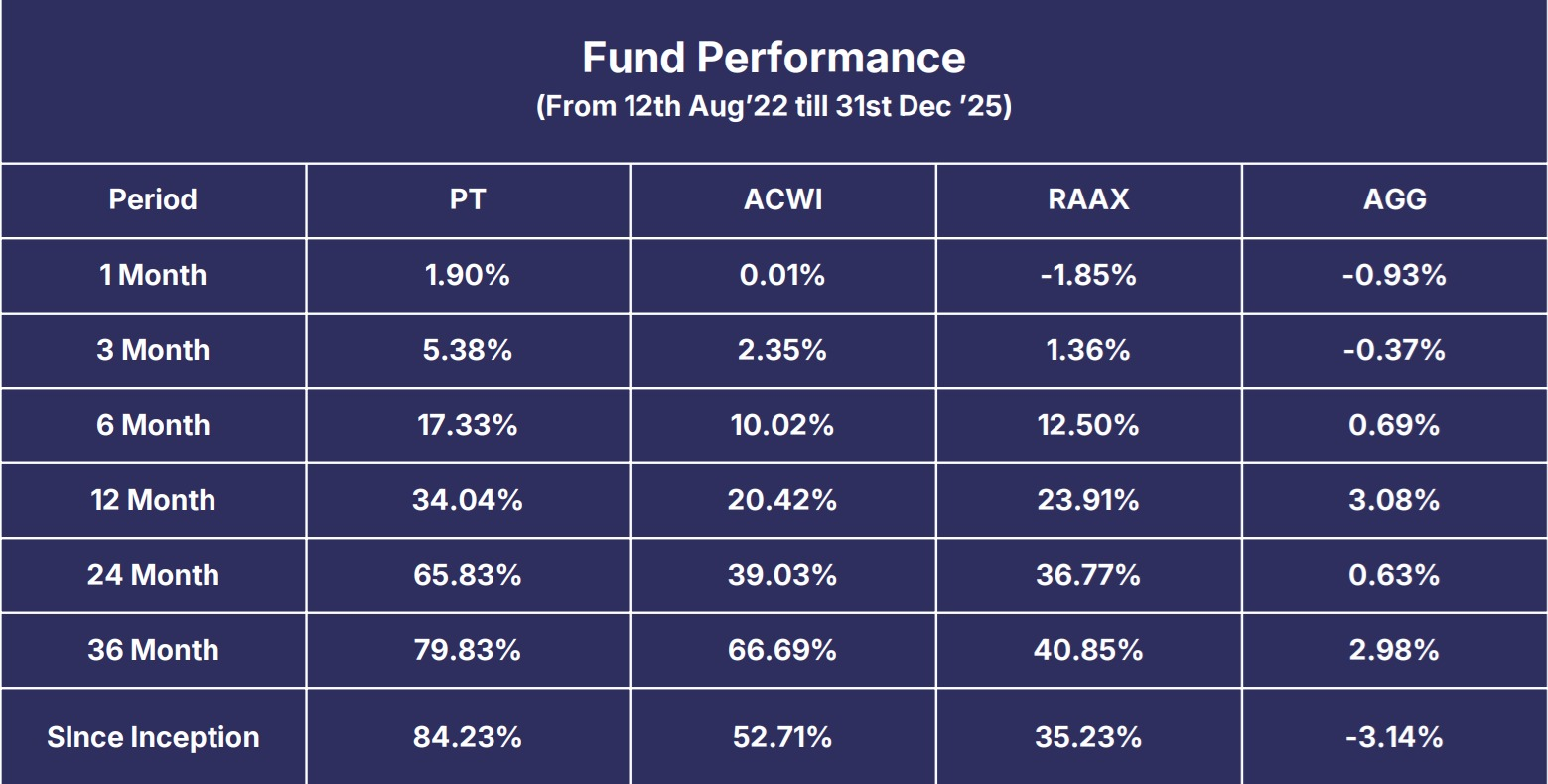

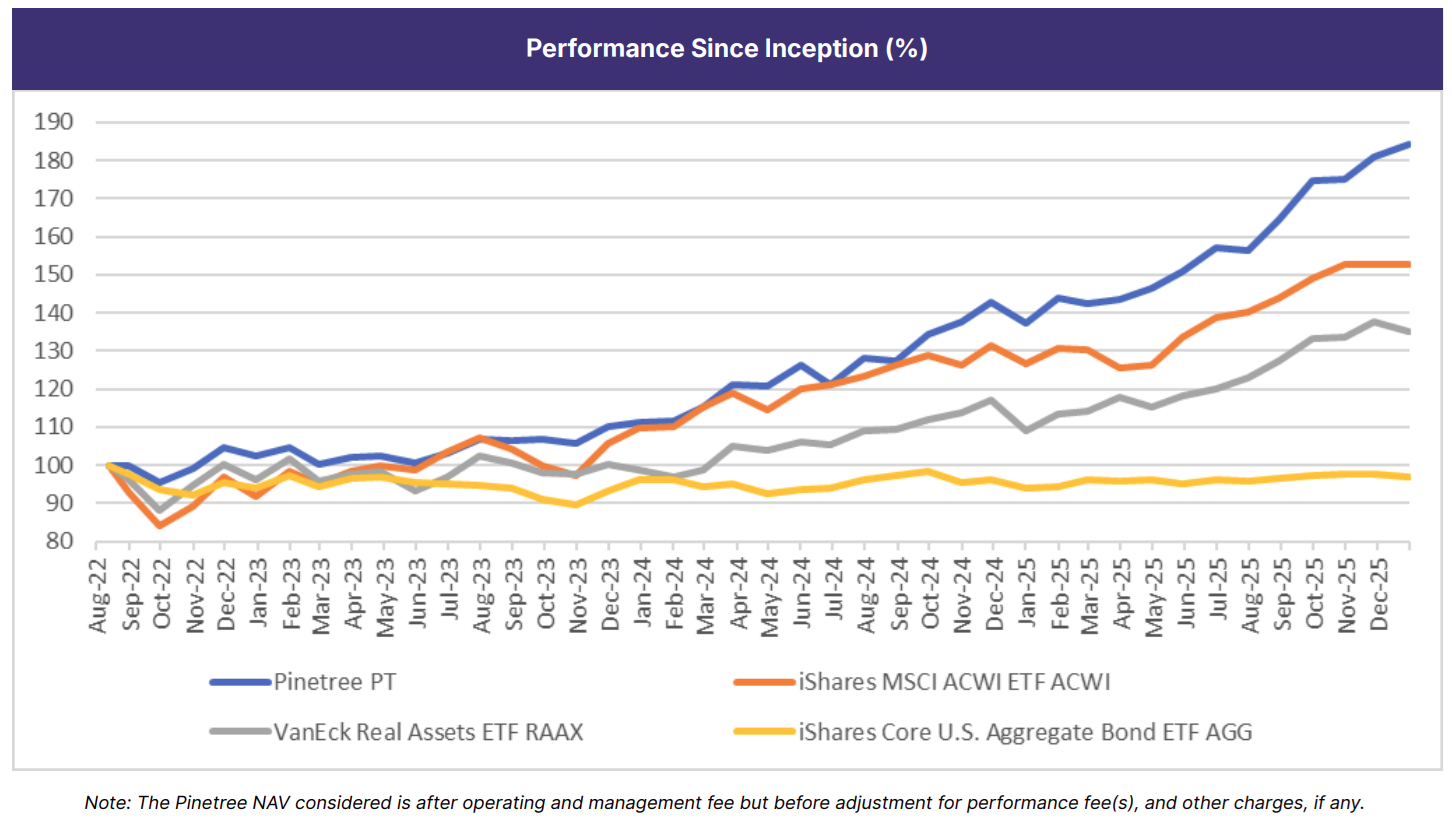

Returns are calculated on a point-to-point basis

Commentary

December closed a volatile year that featured Trump’s emergency tariffs, a breakout in the Bloomberg Commodity Index, and rising evidence of a structural bull market in gold and real assets.

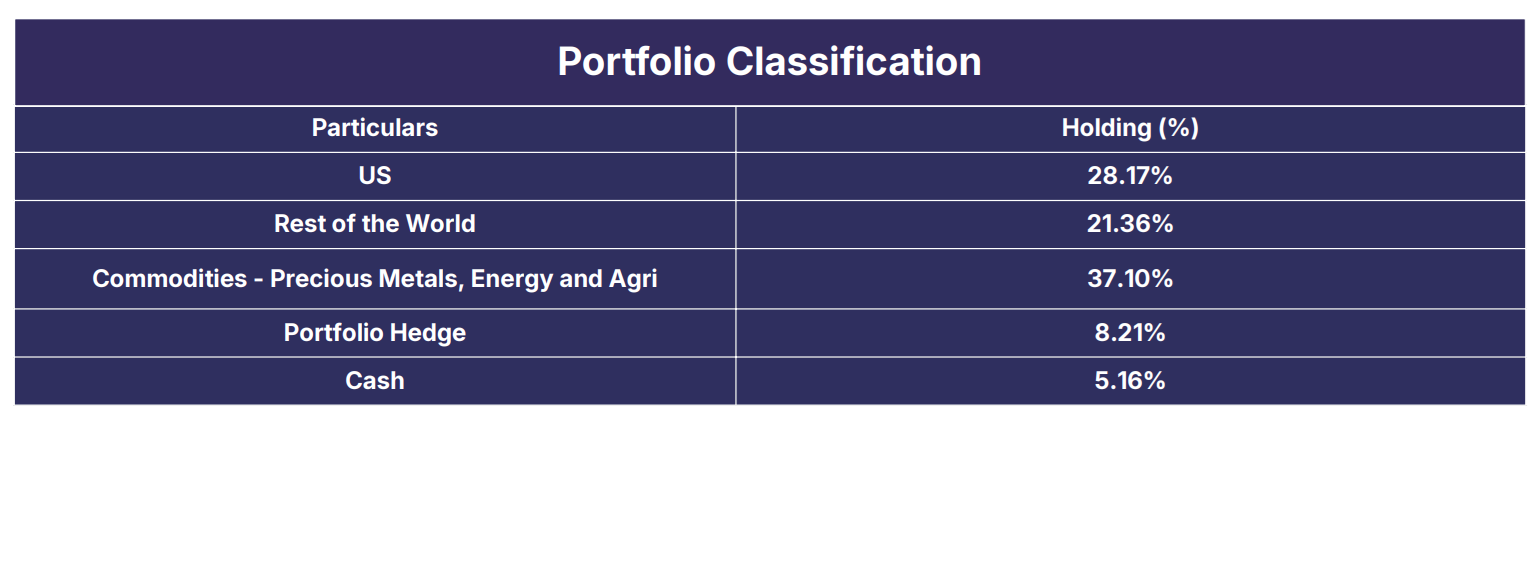

Pinetree remained overweight commodities and gold, while maintaining diversified ETF-led exposure to global commodity equities, consistent with its focus on electrification, nuclear energy, and the broader "real assets" theme.

Pinetree Macro's December-end outlook remains anchored in a macro regime of slowing global growth, sticky inflation impulses, and policy trade-offs that favour real assets and selected equities over broad indices. The fund continues to emphasize electrification, nuclear energy and monetary debasement as the defining forces of this decade, while preparing for rising geopolitical risk and a maturing US equity cycle.

Big picture - Growth, Liquidity and Policy

Global growth is expected to remain subdued, with IMF-style projections around the high-2% range, as tight financial conditions, high public-debt burdens and geopolitical tensions cap the upside. Yield-curve steepening after a prolonged inversion signals that the post-pandemic expansion is entering a late-cycle phase, where recession risk and market volatility rise as policy support wanes.

Core themes into 2026

- US outperformance has likely peaked, with valuations still well above long-term averages and earnings expectations vulnerable to a growth scare in the first half of 2026.

- Electrification and nuclear energy remain the macro theme of the decade, underpinning sustained demand for copper, uranium and related infrastructure, while the energy transition collides with under-investment in legacy supply.

- Gold is viewed as being in a structural bull market, supported by central-bank buying, fiscal dominance in the US and a gradual move toward a more multipolar currency system.

Regional Outlook – where to be selective

- China is increasingly "tradeable" rather than investable, with depressed valuations and periodic policy support creating tactical opportunities but not yet a durable re-rating story.

- Argentina is in the early stages of a potential shale revolution (Vaca Muerta) under reformist policies, positioning the country as an emerging supplier of hydrocarbons just as US shale growth slows.

- Canada faces structural headwinds as heavily leveraged real estate, weakening fiscal anchors and sensitivity to US cycles put Canadian assets at risk of underperforming over the coming years.

India and emerging markets

- India's economic structure is shifting toward manufacturing and high-value services, with select small- and mid-cap companies expected to outperform large caps as capacity-creation and supply-chain diversification accelerate.

- Emerging markets more broadly will be differentiated by external balances and policy credibility, with countries tied to commodity supply chains and manufacturing relocation (e.g., parts of Asia and Latin America) better placed than tourism- or credit-dependent peers.

Portfolio Implications for Pinetree Macro

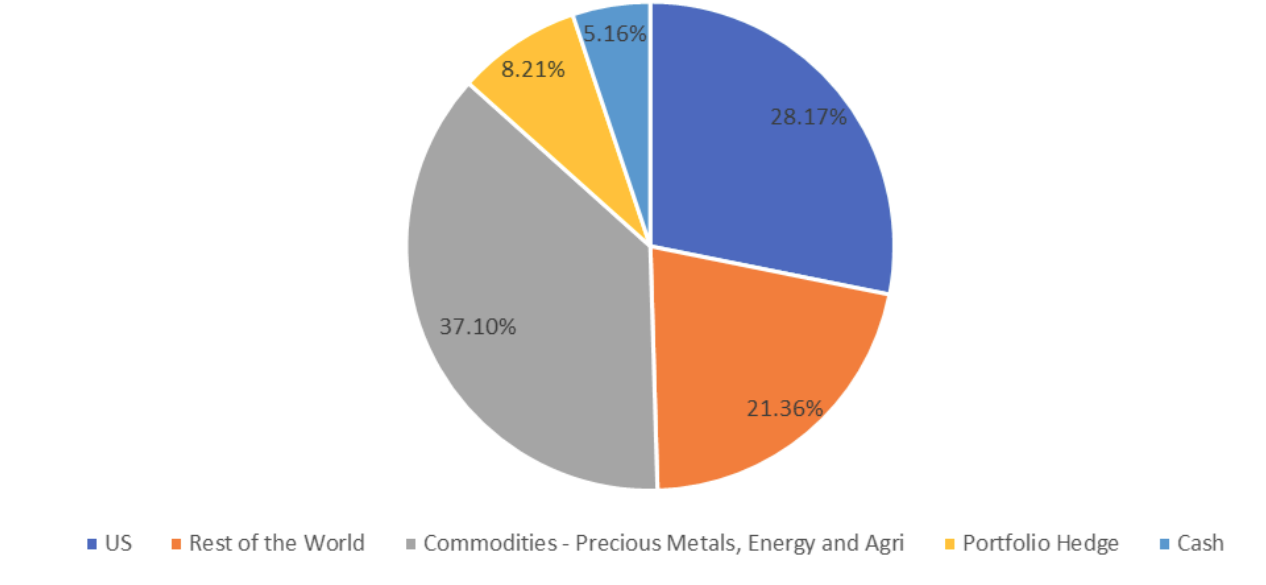

Against this backdrop, Pinetree Macro plans to maintain an overweight in precious metals, miners and other real-asset plays, complemented by targeted exposure to beneficiaries of electrification and nuclear energy. US equity exposure is likely to tilt away from expensive mega-caps toward quality free-cash-flow and value segments, while emerging market positioning will focus on tradeable China exposure, Argentina’s reforms and select Indian small- and mid-cap companies, all buffered by active use of cash and volatility hedges.

Investment Objective

To provide with income generation and capital appreciation through investments in equities, bonds and other related securities of emerging and developed markets. This objective is to be achieved by investing in debt, quasi equity (including convertible bonds, warrants, etc.) and equity shares, both listed and unlisted in, developed, emerging and frontier markets.

| Particulars | Remarks |

|---|---|

| Currency | USD |

| Type | Open ended |

| Minimum Investment | $100,000 |

| Minimum top up post 1st investment | $50,000 |

| Subscription | Weekly, NAV is declared on every Friday and on the last working day of every month |

| Redemption | Anytime, subject to at least 15 calendar days of notice |

| Partial Redemptions | Permitted, subject to post redemption minimum investment at $100,000 |

| Redemption Free/ Exit Load | 1% for exit within 12 months from investing |

| Management Fee | 1% per annum; charged monthly on average AUM |

| Performance Fee | 15% performance fee over hurdle of 7% (subject to high watermark) |

| Operating Fee | On Actuals, capped at 0.5%p.a. on AUM |

| Hurdle Rate | 7% |

| Fund Name | Anantam International SPC Fund – 6 SP (Cayman Island) |

| Investment Manager | Dovetail Investment Management Limited |

| Fund's Bank Account | SBM Bank (Mauritius) Limited |

| Auditor | Forvis Mazars |

| Administrator | Ohm Dovetail Global Admin (IFSC) Private Limited |

Benchmarks

Equity Benchmark – iShares MSCI ACWI ETF (ACWI): Tracks the MSCI All Country World Index, covering large and mid-cap stocks across 23 developed and 24 emerging markets, representing approximately 85% of global equity market capitalization with U.S. exposure of 64.28%. Serves as a comprehensive reference for global equity performance.

Bond Benchmark – iShares Core U.S. Aggregate Bond ETF (AGG): Tracks the Bloomberg U.S. Aggregate Bond Index, representing the U.S. investment-grade bond market including Treasuries, mortgage-backed securities, and corporate bonds. Serves as the standard reference for U.S. fixed income performance.

Real Assets Benchmark – VanEck Real Assets ETF (RAAX): Provides diversified exposure to commodities, natural resource equities, REITs, infrastructure, and gold. Selected to capture the role of real assets as an inflation hedge and as a diversifier against equity and bond risks.

Peers in the space typically use a 60:40 blend of the MSCI World Stock Index and Bloomberg Global Bond Index as a benchmark. However, we have chosen to present three distinct benchmarks, each at 100% weight, to more clearly reflect PineTree’s investment style and asset allocation.

The inclusion of a real assets benchmark reflects our macro view: as early signs of a multipolar currency world emerge, global supply chain efficiency will be tested, driving procurement costs higher. At the same time, developed economies face mounting debt. In this environment, real asset owners such as commodity producers and efficient commodity procurers are well positioned to benefit. Incorporating real assets into the benchmark increases the challenge for our fund, as hard commodities also serve as an important hedge against inflation.

Together, ACWI, AGG, and RAAX provide a transparent framework to evaluate PineTree’s performance across global equities, U.S. fixed income, and real assets. Each benchmark was selected for its accuracy in representing the targeted asset class and relevance to the current macroeconomic environment.