Insight Ahead of its Time: Ritesh Jain’s 2024 Outlook on Trump’s Potential Return

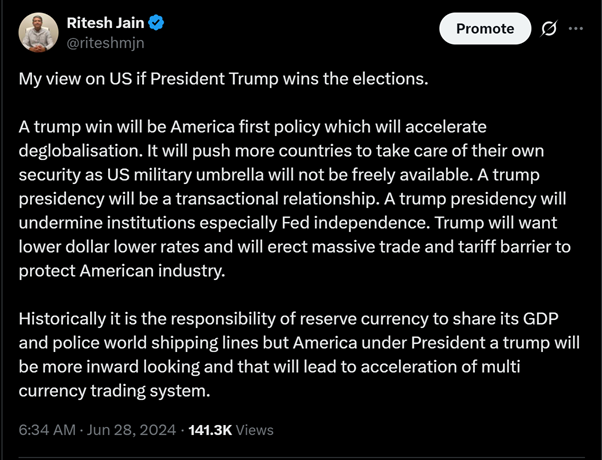

In mid-2024, well ahead of the U.S. elections, Pinetree Macro’s Founder Ritesh Jain shared a sharp, forward-looking perspective on the global macro consequences of a potential Trump victory on his social media handle. His thesis? A Trump presidency would accelerate deglobalisation, disrupt institutional norms, pressure the U.S. dollar, and push the world further toward a multi-currency trade regime.

At the time, it was a bold view. One year later, it has proven remarkably prescient.

The Original Tweet on June 28, 2024:

What Played Out Since Ritesh’s tweet:

- Deglobalisation Intensified

- US Military Commitments Recalibrated

- Institutional Pressures Increased

- Dollar Strategy Recalibrated

- Rise of Multi-Currency Trade

Trump's second term and subsequent policies have leaned heavily on protectionism and self-reliance—triggering retaliatory shifts worldwide.

U.S. allies have been asked to shoulder more of their own security costs (Trump pushing NATO to increase their defence spending to 5% of GDP), with military support from the U.S. no longer assumed to be unconditional.

Fed independence has come under renewed scrutiny amid political pressure for looser monetary policy.

U.S. policy has favoured a weaker dollar to support exports and competitiveness.

Global trade blocs, including BRICS and others, have accelerated non-dollar trade settlements, validating Ritesh Jain’s call.