Anantam International SPC Fund - 6 SP

-

We would love macro investing to be boring but the LIQUIDITY creation and drivers of global LIQUDIITY are constantly changing and in turn influencing the macro landscape.

-

We believe that the easy money for the year is already made and now the time is not to play on front foot but going for small wins.

-

Since early January, the US government debt has remained at $36.2 trillion, but it is expected to increase to $37.7 trillion over the next four months. We are talking about net issuance of $1.5T over next 3 months. A large part of this borrowing will be used to fill up TGA balances which have been run down and have helped expand global liquidity in H12025. This has also kept financial conditions easy in the form of weak US dollar.

-

We added a significant individual position to our portfolio which is a global asset manager focused on precious metals and critical material investments. We believe the best way to play precious metals and energy transition boom is through a focused asset manager. as Aum rises sharply with increasing inflows and underlying asset value appreciation.

To provide with income generation and capital appreciation through investments in equities, bonds and other related securities of emerging and developed markets. This objective is to be achieved by investing in debt, quasi equity (including convertible bonds, warrants, etc.) and equity shares, both listed and unlisted in, developed, emerging and frontier markets.

| Particulars |

Remarks |

| Minimum Investment |

$100,000 |

| Minimum top up |

$1,000 and multiples thereof |

| Subscription |

Monthly last day of each month |

| Redemption |

Monthly, subject to at least 15 calendar days of notice |

| Redemption Free/ Exit Load |

1% on AUM up to 1 year from the investment date. |

| Management Fee |

1% per annum charged monthly on daily average AUM |

| Performance Fee |

15% performance fee over hurdle of 7% (subject to high water mark) |

| Operating Fee |

On Actuals, capped at 0.5%p.a. on AUM |

| Hurdle Rate |

7% |

| Fund Name |

Anantam International SPC Fund - 6 SP |

| Investment Manager |

Arpana Investment Management (Bermuda) |

| Auditor |

Forvis Mazars |

| Administrator |

Ohm Dovetail Global Admin (IFSC) Pvt Ltd |

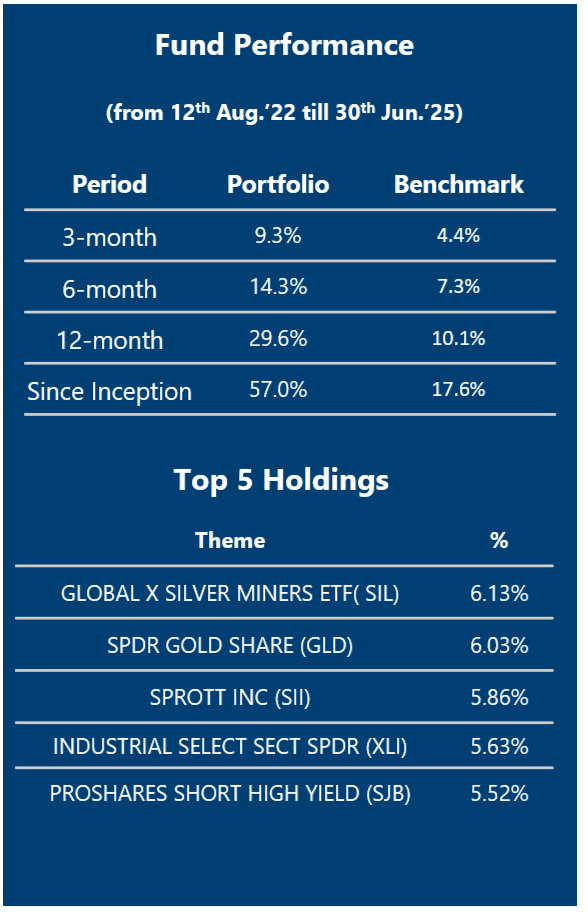

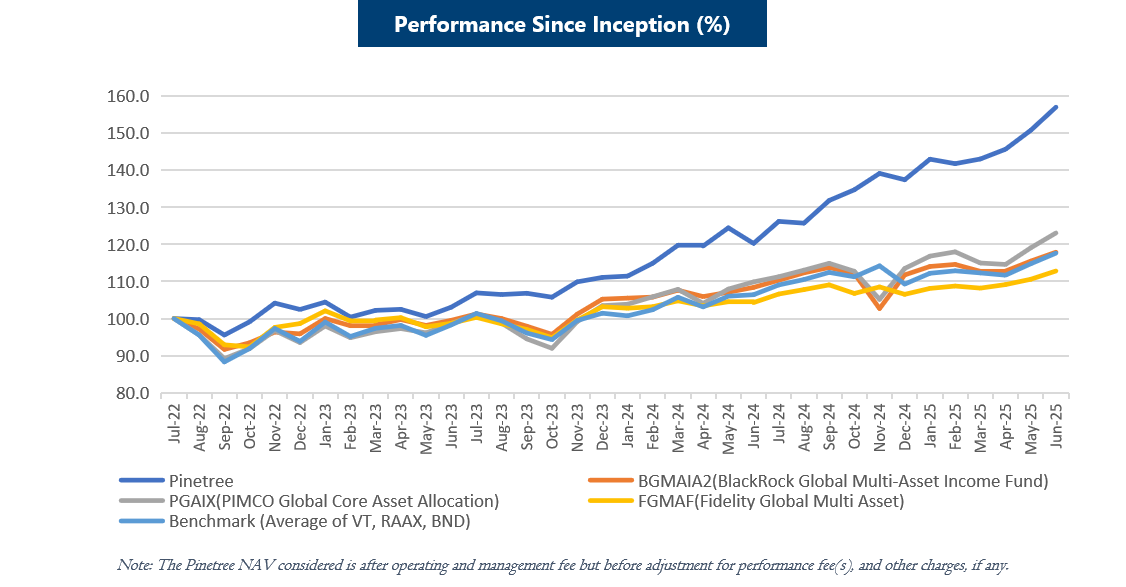

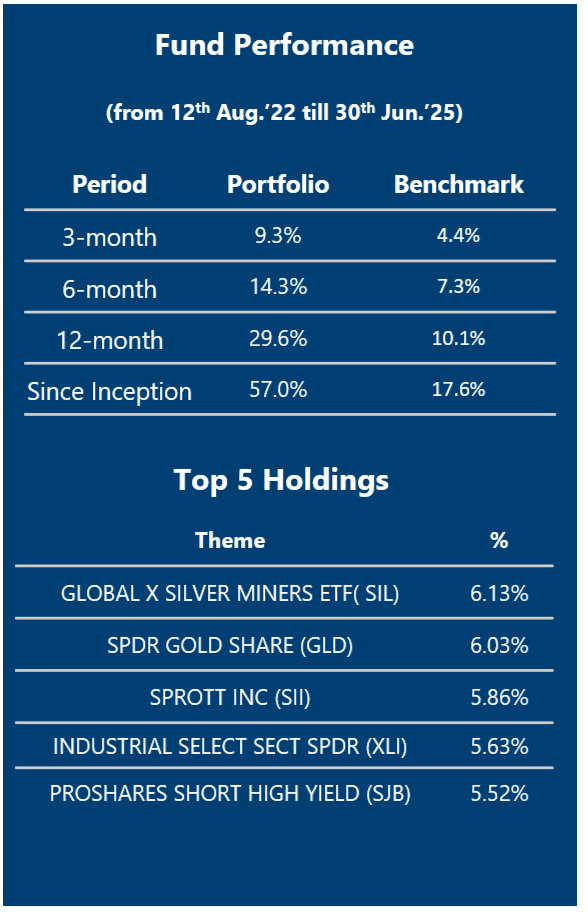

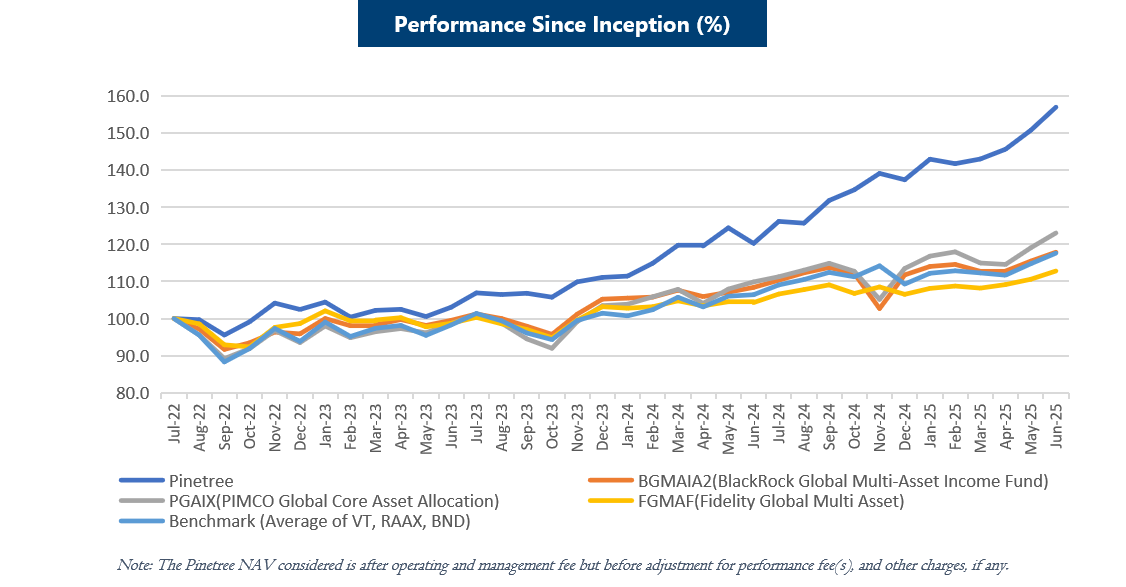

Benchmark is a blend of Vanguard total world stock Index ETF (VT) - 34%, Vanguard total bond market ETF (BND) - 33% & VanEck Inflation Allocation ETF (RAAX) – 33%. ETFs are chosen for the benchmark to reflect the diversified nature of the underlying portfolio. Peers in the space typically use a 60:40 combination of MSCI World stock Index and Bloomberg global bond Index as benchmark.

The reason for including real asset as a part of benchmark - As early sings of multi polar currency world emerges, the efficiency of supply chains will be challenged pushing the cost of procurement upwards. As developed economies struggle through the massive debt burden creating an overhang on fiscal & monetary policies; real asset owners like commodity producers, efficient commodity procurers may emerge as winners. Inclusion of real assets in the Benchmark has increased the challenge for the fund as hard commodities act as inflation hedge.

FOLLOW US:

Website: PINETREE MACRO – Offshore Investments

I can be reached at:

Ritesh Jain

Twitter: @riteshmjn

LinkedIn: https://www.linkedin.com/in/riteshmjain

Disclaimer

Pine Tree Macro Pvt Ltd ("Pine Tree"): This information provided is for the exclusive and confidential use of the addressee only. Any distribution, use or reproduction of this information without the prior written permission of Pine Tree is strictly prohibited. The information and any material provided in this document or in any communication containing a link to Pine Tree’s website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Pine Tree to any registration requirement within such jurisdiction or country. Neither the information, nor any material or opinion contained in this document constitutes a solicitation or offer by Pine Tree or its, directors and employees to buy or sell any securities, futures, options or other financial instruments or provide any investment advice or service. We do not represent that the information and any material provided on this website is accurate or complete. Pine Tree makes every effort to use reliable, comprehensive information; but makes no representations or warranties, express or implied or assumes any liability for the accuracy, completeness, or usefulness of any information contained in this document. All investments are subject to market risks. In no event will Pine Tree or its directors and employees be liable for any damages including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising out of and in connection with this website, or in connection with any failure of performance, error, omission, interruption, defect, delay in operation or transmission, computer virus or system failure.

Anantam International SPC Fund ("Fund") & Aparna Investment Management ("Manager"") : This report does not constitute an offer to sell, nor a solicitation of an offer to buy, interests in Anantam International SPC Fund and is not intended to create any rights or obligations

Aparna Investment Management shall not accept any liability if this report is used for an alternative purpose from which it is intended, nor to any third party in respect of this report. While all reasonable care has been taken in preparing this report, no responsibility and liability is acceptable for errors of fact or for any opinion expressed herein

The Anantam International SPC Fund and/or any of its officers, directors, personnel and employees shall not be held liable and responsible for any loss, damage of any nature, including but not limited to direct, indirect, incidental, punitive, special, exemplary, consequential, as also any loss of profit, revenue in any way arising from or in connection with the use of this statement in any manner whatsoever.

Past performance is not indicative of future results. The Anantam International SPC Fund does not provide any assurances as to the reliability of such information and you should not rely on this information when making an investment decision.

Opinions, projections and estimates contained in this report are subject to change without prior notice.

Registered Office

‘LORDS’, 7/1, Lords Sinha Rd., Kolkata, WB,

700071.

Write to us

info@pinetreemacro.com