Turkey has gone through a period of economic upheaval in the last 2 years with inflation getting out of control and central bank not allowed to raise rates in line with inflation. This is bad news for savers and good news for equity investors and asset owners. We took a call that gains in Turkish equities will be significantly more than the losses arising out of Turkish Lira weakness. The holding period return for this ETF is 58%.

Mexico was an easy call. Mexico is covered under the USMCA agreement and if US were to provide subsidies for onshoring then Mexico would be the biggest beneficiary, as companies can reshore the production to Mexico to take advantage of cheap labour and access to US markets. We recently sold out this ETF after change in political scenario in Mexico as well as overhang of Mr. Trump possibly being the next president of US. He would like to renegotiate the USMCA which would be materially negative for the Mexican peso and Mexican assets. The holding period return of this ETF was 46%.

Gold continues to be our top holding as we believe we are in multi-year bull market for Gold. World has accumulated lot of debt and the only way to reduce the Debt/GDP is to inflate away the debt. Another important point is the G-7 confiscating Russia’s FX reserves which has put fear in the mind of other Central Bankers. They have started diversifying away from US treasuries to Gold which will keep a constant bid under Gold. The holding period return of GLD ETF is 36%.

We were among the first ones to get bullish on the Japan equities because of BOJ policies of financial repression. This along with depressed valuations and increase in buybacks led to a rally in Nikkei along with the falling Yen. We had anticipated this hence we invested in currency hedged Japanese equities etf bypassing the negative impact of the falling Yen. The holding period return of DXJ is 46%.

We anticipated increased bond volatility ahead of time and positioned for it by long bond volatility ETF. The position was sold early this year as we believed regulators would try to engineer soft bond yields which will dampen the bond volatility. The holding period return of this ETF was 47%.

Brief Commentaries on Bottom Performers in the PineTree Portfolio

This is a classic case of view going right but still not able to generate alpha. After start of the Ukraine/Russia war, we anticipated that Natural gas prices will spike in Europe which will also impact the prices in US as it opens arbitrage opportunity which will be closed by increasing US natural gas exports to Europe. US was simply not having enough storage facility to avail of this opportunity and instead had to flare away the excess gas keeping prices depressed in the United states. The holding period return of this ETF was -79%.

There have been occasions where we felt uncomfortable with markets and instead of increased cash levels, we bought equity volatility ETN. The problem with these ETN is that there is a time decay and if the required volatility event does not happen then they lose value fast. We consider it as hedge in times of uncertainty. The holding period return of this ETN was -55%.

We also got excited by the demand for Lithium due to EV and energy transition, but the Lithium carbonate prices collapsed fast as demand could not scale up to the level of expectations and supply started catching up. The holding period return of this ETF was -29.5%.

Vietnam was and is one of our favourite market in the South-East Asia but corruption scandals and bank failure took the shine out this small but very productive country. The Hanoi index and the Vietnamese Dong, both got hit simultaneously which exaggerated the losses in USD terms. The holding period return of this ETF is -28.5%.

This is the first AI powered Equity ETF, and we invested in this ETF more out of curiosity and to closely observe the changing asset allocation. The ETF massively underperformed the benchmarks. So, in our view, AI, for now, is not ready to take over asset allocation yet. The holding period return of this ETF was -16.5%.

Investment Objective

Capital appreciation via investments in a combination of Equity, Fixed income, Commodities and other thematic cross country asset classes

Investment Objective

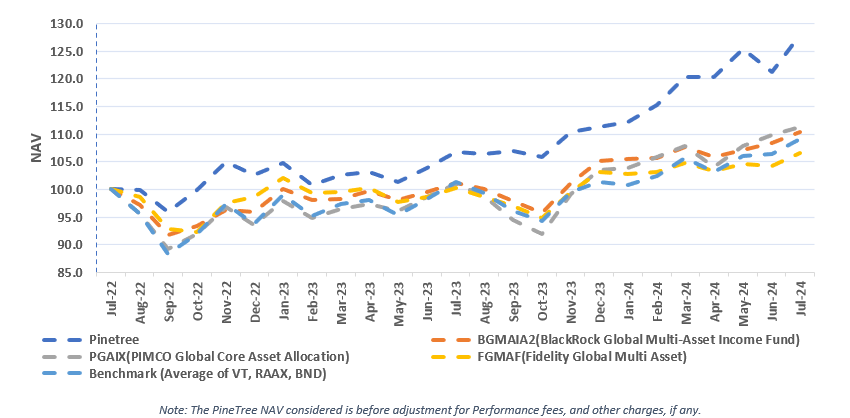

Benchmark is a blend of Vanguard total world stock Index ETF (VT) – 34%, Vanguard total bond market ETF (BND) – 33% & VanEck Inflation Allocation ETF (RAAX) – 33%. ETFs are chosen for the benchmark to reflect the diversified nature of the underlying portfolio. Peers in the space typically use a 60:40 combination of MSCI World stock Index and Bloomberg global bond Index as benchmark.

The reason for including real asset as a part of benchmark – As early sings of multi polar currency world emerges, the efficiency of supply chains will be challenged pushing the cost of procurement upwards. As developed economies struggle through the massive debt burden creating an overhang on fiscal & monetary policies; real asset owners like commodity producers, efficient commodity procurers may emerge as winners. Inclusion of real assets in the Benchmark has increased the challenge for the fund as hard commodities act as inflation hedge.

Investor Update | July 2024

Performance Since Inception (%)

Brief Commentaries on Top Performers in the PineTree Portfolio

Turkey has gone through a period of economic upheaval in the last 2 years with inflation getting out of control and central bank not allowed to raise rates in line with inflation. This is bad news for savers and good news for equity investors and asset owners. We took a call that gains in Turkish equities will be significantly more than the losses arising out of Turkish Lira weakness. The holding period return for this ETF is 58%.

Mexico was an easy call. Mexico is covered under the USMCA agreement and if US were to provide subsidies for onshoring then Mexico would be the biggest beneficiary, as companies can reshore the production to Mexico to take advantage of cheap labour and access to US markets. We recently sold out this ETF after change in political scenario in Mexico as well as overhang of Mr. Trump possibly being the next president of US. He would like to renegotiate the USMCA which would be materially negative for the Mexican peso and Mexican assets. The holding period return of this ETF was 46%.

Gold continues to be our top holding as we believe we are in multi-year bull market for Gold. World has accumulated lot of debt and the only way to reduce the Debt/GDP is to inflate away the debt. Another important point is the G-7 confiscating Russia’s FX reserves which has put fear in the mind of other Central Bankers. They have started diversifying away from US treasuries to Gold which will keep a constant bid under Gold. The holding period return of GLD ETF is 36%.

We were among the first ones to get bullish on the Japan equities because of BOJ policies of financial repression. This along with depressed valuations and increase in buybacks led to a rally in Nikkei along with the falling Yen. We had anticipated this hence we invested in currency hedged Japanese equities etf bypassing the negative impact of the falling Yen. The holding period return of DXJ is 46%.

We anticipated increased bond volatility ahead of time and positioned for it by long bond volatility ETF. The position was sold early this year as we believed regulators would try to engineer soft bond yields which will dampen the bond volatility. The holding period return of this ETF was 47%.

Brief Commentaries on Bottom Performers in the PineTree Portfolio

This is a classic case of view going right but still not able to generate alpha. After start of the Ukraine/Russia war, we anticipated that Natural gas prices will spike in Europe which will also impact the prices in US as it opens arbitrage opportunity which will be closed by increasing US natural gas exports to Europe. US was simply not having enough storage facility to avail of this opportunity and instead had to flare away the excess gas keeping prices depressed in the United states. The holding period return of this ETF was -79%.

There have been occasions where we felt uncomfortable with markets and instead of increased cash levels, we bought equity volatility ETN. The problem with these ETN is that there is a time decay and if the required volatility event does not happen then they lose value fast. We consider it as hedge in times of uncertainty. The holding period return of this ETN was -55%.

We also got excited by the demand for Lithium due to EV and energy transition, but the Lithium carbonate prices collapsed fast as demand could not scale up to the level of expectations and supply started catching up. The holding period return of this ETF was -29.5%.

Vietnam was and is one of our favourite market in the South-East Asia but corruption scandals and bank failure took the shine out this small but very productive country. The Hanoi index and the Vietnamese Dong, both got hit simultaneously which exaggerated the losses in USD terms. The holding period return of this ETF is -28.5%.

This is the first AI powered Equity ETF, and we invested in this ETF more out of curiosity and to closely observe the changing asset allocation. The ETF massively underperformed the benchmarks. So, in our view, AI, for now, is not ready to take over asset allocation yet. The holding period return of this ETF was -16.5%.

Investment Objective

Capital appreciation via investments in a combination of Equity, Fixed income, Commodities and other thematic cross country asset classes

Investment Objective

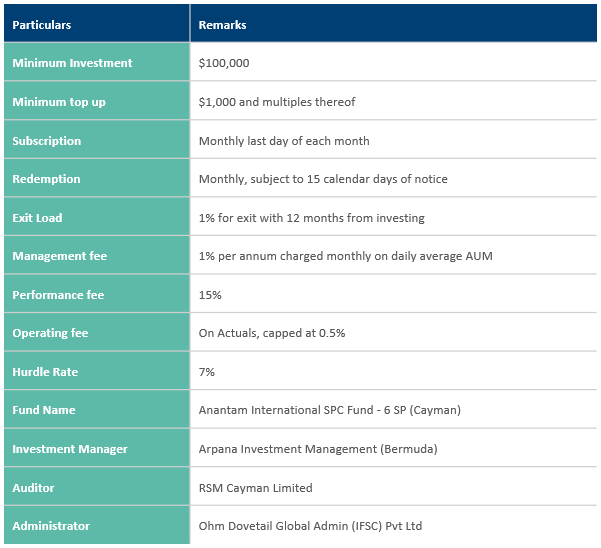

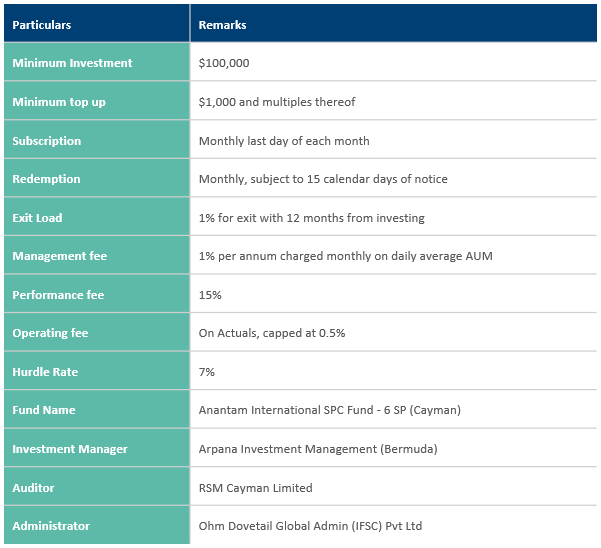

Benchmark is a blend of Vanguard total world stock Index ETF (VT) – 34%, Vanguard total bond market ETF (BND) – 33% & VanEck Inflation Allocation ETF (RAAX) – 33%. ETFs are chosen for the benchmark to reflect the diversified nature of the underlying portfolio. Peers in the space typically use a 60:40 combination of MSCI World stock Index and Bloomberg global bond Index as benchmark.

The reason for including real asset as a part of benchmark – As early sings of multi polar currency world emerges, the efficiency of supply chains will be challenged pushing the cost of procurement upwards. As developed economies struggle through the massive debt burden creating an overhang on fiscal & monetary policies; real asset owners like commodity producers, efficient commodity procurers may emerge as winners. Inclusion of real assets in the Benchmark has increased the challenge for the fund as hard commodities act as inflation hedge.